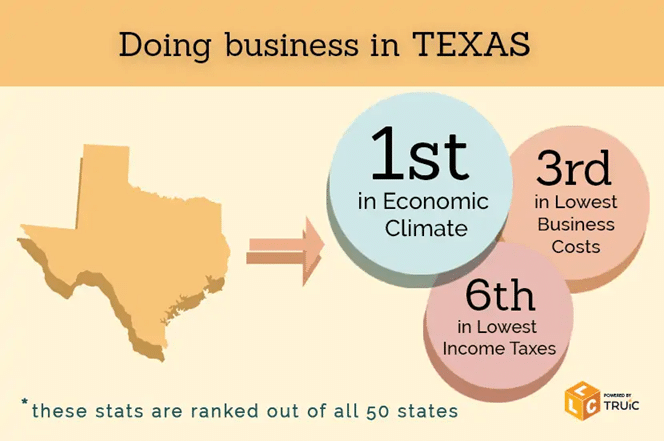

With the 3rd Lowest business costs in the country, Texas is a great place to launch your business. The Texas-side of the Texarkana area offers one of the best business ecosystems in the nation. Businesses thrive here because of our excellent geographic location, highly skilled workforce, low tax burden, reasonable cost of living, predictable regulatory environment and our reputation for having a truly business friendly climate.

Utility Costs

Coming Soon!

Taxes

Texas is one of only seven states that has no personal income tax as of 2019. Most of Texas’ tax revenues come from sales taxes and taxes on businesses and specific industries. The state does have a property tax, but it is collected by cities, counties, and school districts, and it can only be used for local needs.

All told, Texas is very tax-friendly. According to the Tax Foundation, its overall state and local tax burden ranked 46th among all states in 2016, the last year for which comprehensive statistics are available. The tax burden here comes in at just 7.6%.

Rates:

There is no city/municipal tax levied on the TexAmericas Center footprint, which acts as a lifetime automatic tax exemption when compared to other state of Texas locations, as well as those world-wide. (View Estimated Tax Values for Bowie County). TexAmericas Centers tax rate is less than 2%, making it 20% to 30% lower than other major Texas markets.

Structure:

Coming Soon!

Ongoing Investments:

Interstate 30 to become six lanes

Franchise Tax:

Although Texas has no individual income tax, it does levy a franchise tax of .375% on some wholesalers and retail businesses as of 2019. The rate increases to .75% for other non-exempt businesses. Also called a “privilege tax” this is a type of income tax based on total business revenues exceeding $1.13 million. Sole proprietorships and some general partnerships are exempt.

Franchise tax reports are due annually on May 15, or the next business day when this date falls on a weekend or a holiday. Interest on past due franchise debts begins accruing 61 days after the due date, and penalties of up to 10% can apply as well.

Property Taxes:

Property taxes are based on the appraised current market value of real estate and Business personal property that is income-producing tangible personal property. Business personal property or business contents refers to movable items owned by your business. It includes inventory, office supplies, furniture, computers, machinery – basically everything except for the building itself. “Income-producing” is the key phrase when it comes to business personal property.

As for real estate, appraisals are performed by county districts. The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts and are based on yearly budgets and how much revenue the districts need to cover their costs. Local governments hold public hearings to discuss tax increases, and Texas citizens can petition for a public vote on an increase if it exceeds certain limits.

For the most part, Texas has uniform rules regarding key deadlines and reporting procedures.

As there may be variances across the states Central Appraisal Districts (the term Texas uses to refer to local assessors), we recommend double-checking policies pertain to your specific circumstances and this location.

In general, however, these are the key dates that Texas business personal property holders need to know:

|

KEY DATES |

EXPLANATIONS |

|

January 1 – Lien date for all property |

Businesses must report all assets on the books as of this date, in the current year. |

|

April 1 – Return deadline |

Rendition (tax return) due date, by mail or electronically. (This date is new as of 2018; it used to be 4/15.) |

|

May 1 – Return extended deadline |

Returns that have been granted an extension are due by this date. (This date is new as of 2018; it used to be 5/15.) |

|

October – December |

Tax bills are issued |

|

April 30 – Exemption forms due |

Some Texas businesses filing commercial property tax may be eligible for special tax exemptions, and as such must submit the appropriate requests suing the appropriate forms. |

Real Property

Real property includes land, improvements (including house), uncut timber, and mineral rights. TexAmericas Center retains its right to minerals and uncut timber on leased land, limiting your potential for tax liability.

Important things to remember if you opt to lease your land and building from TexAmericas Center:

- Your property tax liability is handled through your lease agreement via the section detaining your Payment in Lieu of Taxes (PILOT) agreement.

- Working in conjunction with the Bowie county assessor’s office TexAmericas Center will determine your tax liability.

- You will make your PILOT payment directly to TexAmericas Center.

- TexAmericas Center will use these funds to perform utility and transportation infrastructure maintenance and improvements and remit an amount to the appropriate taxing entities. Providing that a separate agreement with the tenant does not supersede.

Important things to remember if you opt to own your land and building:

- TexAmericas Center has one of the lowest aggregate tax rates in the State of Texas:

a) There is no municipal Tax rate

b) Bowie County has one of the lowest tax rates in the State of Texas

c) Texarkana College tax rate is below the State of Texas average for community colleges

2. You are eligible for certain tax advantages and incentives, but must ask how to access them.

Business Personal Property

Important things to remember:

- You are only required to report what your company owns and is located on your property on January 1

- TexAmericas Center has one of the lowest aggregate tax rates in the State of Texas:

a) There is no municipal Tax rate

b) Bowie County has one of the lowest tax rates in the State of Texas

c) Texarkana College tax rate is below the state of Texas average for community colleges

3. You are eligible for certain tax advantages and incentives, but must ask how to access them

Regulatory Environment

The Texas economy is strong, and its workforce is among the best in the country. Texas businesses are doing great, but there is always room for improvement and that one area where Texas can still do much better—regulation.

The state’s strong economy, modern infrastructure, and innovative workforce all contributed to its top placement with CNBC 2109 poll and was up from #4 in 2018. When it comes to the cost of doing business and overall business friendliness, Texas ranked 18th and 21st, respectively. CNBC credited the state’s better than average performance on business friendliness to a “sometimes difficult legal climate”—which sounds like short-hand for regulation.

There is a lot of regulation, much of requiring a company to do or not do something. That explains why Texas, despite being number one for business overall, still has a lot of room for improvement. The largest area of road blocks tend to relate to economic regulation such as complicated licensing requirements.

TexAmericas Center has excellent working relationships with elected officials at all levels, federal, state and local. Further we know leadership at many local facilities that have representations in DC and Austin. Finally, we engage our own support staff in both locations.

Let us be a member of your team and we will use our resources to help you maneuver through the sometimes-complicated isles of regulation and legislation to keep your project on track.

Timeline and Cost for Approval Processes

-

Wastewater – Coming Soon!

-

Hazardous Waste – Coming Soon!

-

Emissions – Coming Soon!

-

Storm Water Runoff – Coming Soon!

-

Building Permits -Coming Soon!

-

Site Prep Permits – Coming Soon!

The Texas Advantage

Coming Soon!

The combined federal and state corporate tax for Texas is tied as the lowest in the nation and is the lowest among all southern states. Texas also collects no income tax and our area has the lowest aggregate property tax in the state. TexAmericas Center boasts costs for labor, electricity, and local taxes of 80% of the state of Texas standard. TexAmericas Center is positioned to offer a valuable operational advantage when an incentive package is included.